Mar 27, 2024

Traders See Yen at 152 Per Dollar as ‘Line in The Sand’ for BOJ

, Bloomberg News

(Bloomberg) -- In the hours after the yen hit a 34-year low on Wednesday, Japanese officials put currency traders on notice: Keep this up and we’ll act forcefully in the market to stem the slide.

The message was heeded, at least initially.

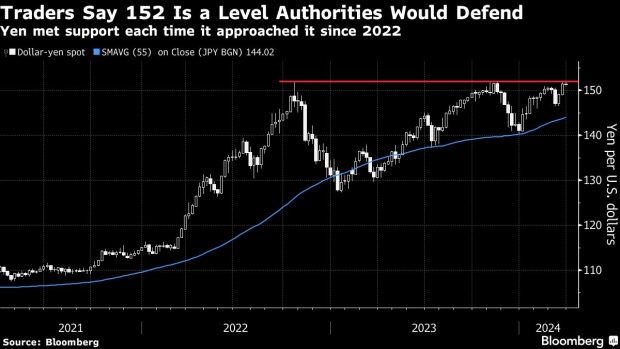

After coming within a whisker of touching 152 per dollar — a level that a slew of market observers said would likely prompt authorities to intervene directly — the yen reversed course on warnings from Japan’s finance minister and then news that the nation’s economic authorities were gathering for an unscheduled meeting.

But the rebound was modest and faded as the day wore on. The yen was little changed at 151.35 as of 8:30 a.m. in Tokyo on Thursday. That’s only about 0.4% stronger than the weak point set on Wednesday, showing how tough it may be to alter market sentiment. The moves also capture just how jittery traders have become around the yen’s slide. It has lost about 7% this year against a broadly advancing dollar, making it among the weakest major currencies.

“Market perception is they have drawn a line in the sand at 152,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi, US. “The key question is their commitment.”

Profitable Bet

For months, betting against the yen has been profitable as the Bank of Japan stuck to a program of negative interest rates to help combat deflation. The latest leg of yen losses came even after the BOJ tightened policy last week for the first time in 17 years, while also signaling that it wasn’t about to embark on a series of rate hikes.

Japanese officials delivered their latest round of warnings Wednesday as the yen weakened past a level at which policymakers stepped in October 2022. Authorities in Tokyo spent ¥9.2 trillion ($61 billion) in 2022 to prop up the yen on three occasions.

For policy makers, the challenge is that after fretting for decades that inflation was dangerously low, the threat now is that a plunging yen could trigger a spike in prices that would derail an economy that is hugely reliant on imports of key products such as oil.

The yen’s relentless slide is a sign that BOJ policy remains too loose to anchor the yen, especially with the Federal Reserve holding its benchmark rate at the highest in more than two decades and likely months away from a potential move to ease.

“The bottom line is that it is mainly Fed and BoJ policy which is driving this move, and they only have (some) control over one of those,” said Peter Vassallo, a portfolio manager in New York at BNP Paribas Asset Management.

Speculative Call

For their part however, Japanese officials say the recent moves have been speculative, with Japan’s top currency official Masato Kanda earlier Wednesday pledging to take appropriate action against excessive swings in the market. He later said, following a three-way meeting between the ministry, the central bank and financial regulator, that speculative moves in markets wouldn’t be tolerated.

Finance Minister Shunichi Suzuki also said earlier in the day that the government will take bold measures against excessive moves without ruling out any options.” Suzuki’s reference to bold action is generally interpreted to mean direct intervention in the currency market.

“The rise in USD/JPY towards 152 has clearly rattled a few cages in Tokyo,” said Peter Kinsella, the global head of FX strategy at Union Bancaire Privee. “I expect interventions sooner rather than later.”

Read more: Japan FX Chief Ramps Up Warning After Yen Hits 34-Year Low

Other market watchers are taking a more sanguine approach, saying the outright level of the yen matters less than the scale and scope of the daily moves.

“If we gapped through 152 and then up to 155 in a very short period then maybe they would jump on it, but if we are just bouncing around and grinding higher, not so much of a concern,” said Brad Bechtel, global head of FX at Jefferies.

Vulnerable Positions

However, for those betting on a continued slide, the risks are building.

Citigroup Inc. strategists including Daniel Tobon say the short yen trade is looking “crowded” and that bets on further losses could be vulnerable, adding that intervention is likely between 152 and 155.

Hedge funds ramped up bearish yen wagers in the week stretching through the BOJ’s March meeting, according to data as of March 19. Speculative traders have been consistently short the yen since 2021, according to the Commodity Futures Trading Commission, with the trade remaining popular in recent months.

At Vanguard, whose actively managed fixed income funds don’t have any active positions in the yen at the moment, intervention could actually represent a trading opportunity.

“We would use pullbacks caused by intervention to re-enter a long USDJPY position. Any intervention would be a great opportunity to buy,” said Ales Koutny, head of international rates at Vanguard Asset Management.

--With assistance from Sujata Rao, Greg Ritchie, Vassilis Karamanis, Carter Johnson, Anya Andrianova, George Lei and Yumi Teso.

(Updates market moves.)

©2024 Bloomberg L.P.