Apr 26, 2024

Macron Dodges Debt Warning as Rating Firms Hold Views on France

, Bloomberg News

(Bloomberg) -- Emmanuel Macron avoided a reprimand of his stalling efforts to tackle France’s bloated debt burden as two rating firms kept their assessments of the country’s creditworthiness unchanged.

Both Moody’s Ratings and Fitch Ratings made no changes to their outlook or grade of France on Friday, when they had scheduled possible action.

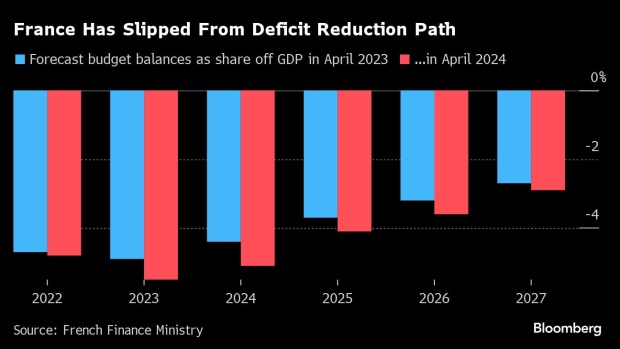

The reprieve comes as Macron’s government struggles to keep a grip on public finances after last year’s deficit came in much wider than initially planned amid weak growth and tax receipts.

The finance ministry already responded to the deterioration with additional spending cuts this year. But the belt-tightening is insufficient to get back on track and officials have also pared back long-term pledges to fill budget holes.

France’s High Council of Public Finance said Macron’s latest fiscal plan lacks credibility and coherency as it requires unprecedented cuts that would hurt economic growth.

Macron is also facing a difficult political backdrop with Marine Le Pen’s National Rally far ahead of his centrist alliance in polls for the European Elections and some lawmakers threatening to trigger no-confidence votes that could ultimately bring down his government.

Fitch, which downgraded France a year ago to 7 levels above junk at AA-, said on Friday that the high level of debt and “poor record of fiscal consolidation” are a “rating weakness.” It listed public borrowing and deficits and materially lower economic growth prospects as reasons that could lead to negative action.

Similarly, Moody’s warned of such steps on its Aa2 rating if it concluded the deterioration in France’s debt costs were significantly larger than in its rating peers. It also said a weakening commitment to fiscal consolidation would increase downward credit pressures.

Commenting after the announcements, French Finance Minister Bruno Le Maire said the government remains determined to bring the budget deficit within 3% of economic output by 2027.

“We will stick to our strategy based on growth and full employment, structural reforms, and reducing public spending,” he said in a statement.

France will run the gauntlet of another rating decision May 31 when S&P, which has a negative outlook on its AA rating, is scheduled to report.

Investors had been alive to the prospect of ratings action on France. The country’s debt, long considered one of the safest in the euro area — arguably second only to Germany’s — has gradually been decoupling as the fiscal picture worsens. The extra yield on 10-year bonds over German securities has doubled from pre-Covid levels.

Also notable is French debt’s under-performance versus Spanish, Italian and Portuguese securities, which have lower credit scores. The extra cost paid by Spain to borrow compared to France has almost halved over the past six months.

©2024 Bloomberg L.P.