Apr 1, 2024

Larry Berman: Full employment good for earnings until it's not

By Larry Berman

Larry Berman's Educational Segment

Wall Street has a few rules of thumb that rarely pay to bet against. I’m the worst violator of this adage. Given my focus on valuation, I struggle when markets get expensive. But it rarely pays to bet against the U.S. consumer.

Last week we saw the recent update from the Bureau of Economic Analysis on U.S. consumption. Basically, as long as the consumer is working and spending, it’s good for markets and earnings. This week we get another look at the U.S. employment situation.

In recent months, we have seen some decay at the state level, but broadly speaking, the job picture is still relatively strong, though many recent jobs are more part-time than full-time, which typically suggests second jobs for many. In the past few months, the U.S. economy has lost about 2 million full-time jobs and on a year-over-year basis, there have been no full-time jobs added.

When we look at the mix of jobs, the job losses over the past year have mostly been from the manufacturing recession we have seen. That notion is a bit odd given the global shift to more manufacturing in the U.S. and less reliance on global trade for supply chains that we are seeing.

The biggest sectors of the economy that are seeing good job growth are healthcare (think aging population), leisure and hospitality (restaurants, travel), construction (lack of housing) and government (less productive). When we look at the state-level data, we see that the job growth is not broad. About 20 states are seeing net declines or no growth at all.

Historically, the key to a recession is the labour market and all eyes will be on the trends here.

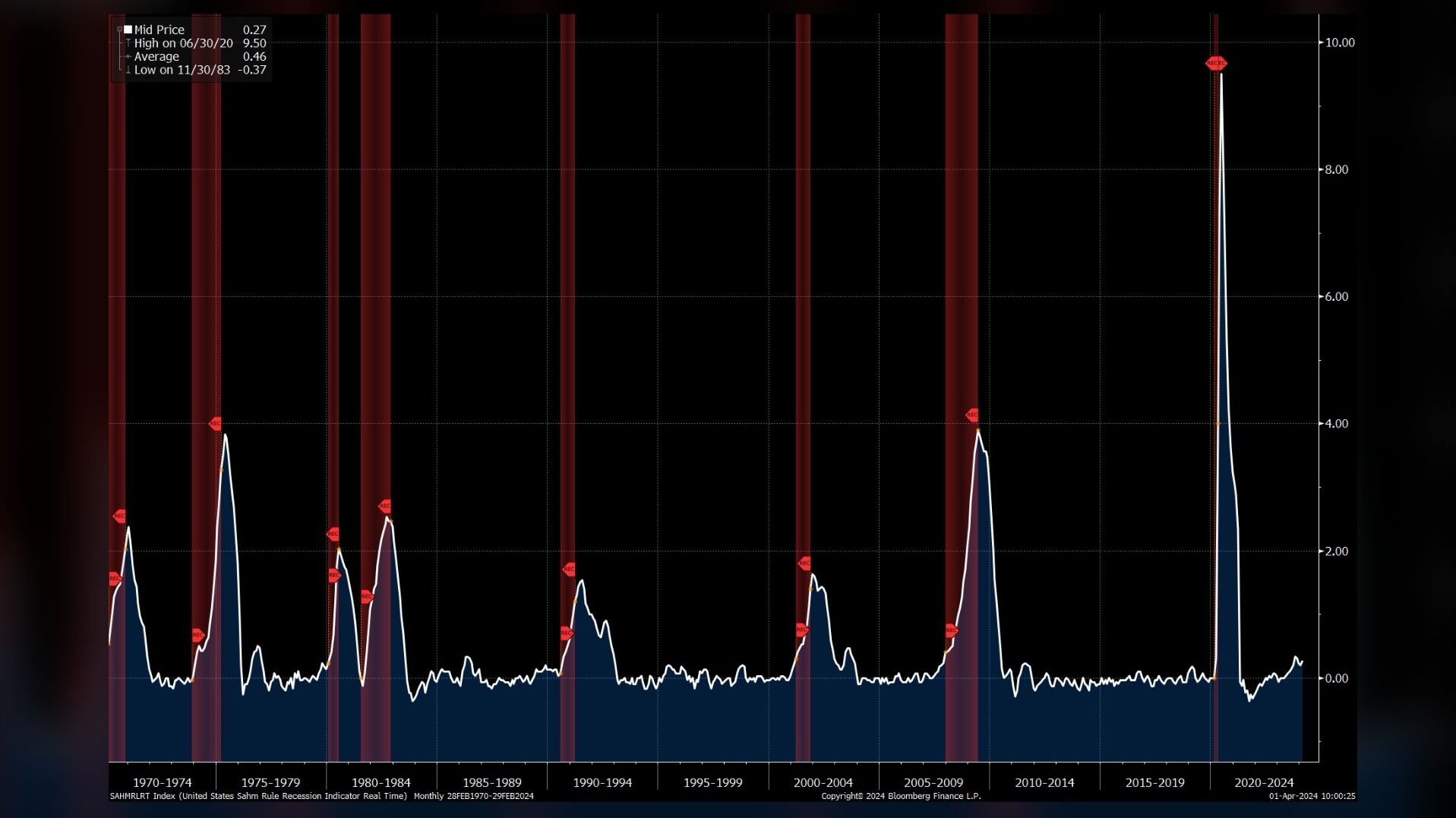

Claudia Sahm, a former Fed economist, created the Sahm rule that has called every recession with perfection. It states that the Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

It will possibly trigger a recession call sometime in the next few months if the decay in the breadth of the labour market continues. This may be the next best indicator of when the stock market may start to respond to a likely drop in earnings. Currently, stocks remain priced for a perfect landing with no recession.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com