Mar 28, 2024

Foreign Turkey Stock Bears Cut Back on ETF Short Positions

, Bloomberg News

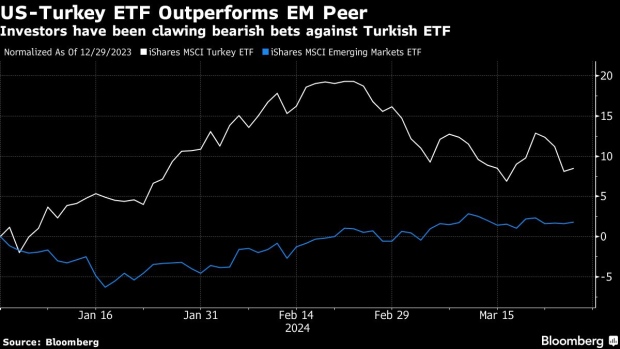

(Bloomberg) -- Foreign investors have been cutting down their bets against Turkish stocks, with short positions on an exchange-traded fund declining.

Data from S3 Partners shows a dwindling trend in short positions in the iShares MSCI Turkey ETF, with the number of stocks shorted falling to about 387,000 this month, the lowest level in at least a year. Separate data from IHS Markit Ltd also supports the data on the drop, with 4.6% of the outstanding shares of the ETF sold short, the lowest level in two months.

While the New York-traded fund is small by ETF standards, with only $203 million in assets, it’s seen as a gauge of international investors’ stance on Turkish stocks. The dollar-denominated ETF is up 8.5% so far this year and has attracted $5.8 million of inflows over the period.

Since presidential elections last year, when Turkey’s President Recep Tayyip Erdogan made U-turn on unconventional monetary policies that kept overseas investors on the sides for years, foreigners have purchased a net $2.6 billion of Turkish stocks. While they have sold some of their holdings this year, a decline in short positions suggest foreign investors aren’t keen to keep their bearish wagers at high levels for the time being.

Foreigners Key to Turkish Stocks as Locals Lured by Higher Rates

Investors have covered about 247,000 short positions, worth $9 million, in the iShares ETF this year, according to data shared by Ihor Dusaniwsky, managing director of predictive analytics at S3. That’s a 39% decrease in total shares shorted, much higher figure than the rise in the ETF’s price, Dusaniwsky said.

Still, despite the return of foreign investor optimism, their ownership of Turkish stocks at 37.8% remain lower than the historical average of around 60%.

“Capital markets took the changes in economic policies in 2023 positively and the commitment by the government to uphold them has strengthened the Turkish case again,” said Sebastian Kahlfeld, a portfolio manager at DWS Investment. “We maintain a cautious attitude toward Turkish equities, though we see positive re-rating potential if the reform momentum is being maintained.”

©2024 Bloomberg L.P.