Apr 17, 2024

Yuan Usage Extends Global Climb as Euro Share Slips, Swift Says

, Bloomberg News

(Bloomberg) -- The Chinese yuan is accounting for a growing share of international payments, while the euro’s share continues to ebb, according to transaction data compiled by global financial messaging service Swift.

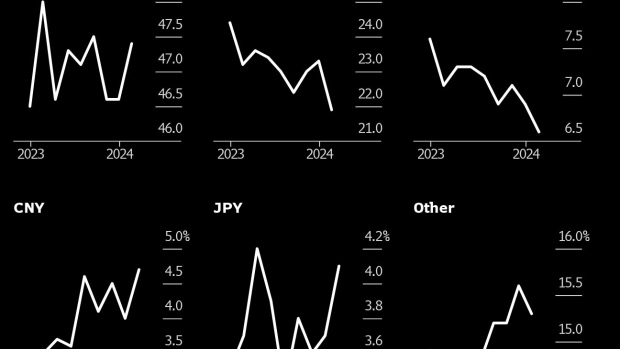

The portion of transactions involving the yuan rose to 4.7% in March, the highest since Swift created a new baseline in July. The euro’s share dipped below 22% last month, under the 24.4% level logged when Swift introduced the new scale.

Global banks use Swift, or the Society for Worldwide Interbank Financial Telecommunication, to communicate with each other and manage interbank currency deals. The consortium began assembling the data in 2010, but the figures since July reflect a technical adjustment to how Swift tracks the data based on recently revised trade reporting standards.

The yuan has been the world’s fourth-most transacted currency since November, according to Swift data — overtaking the yen for the first time since 2022. China’s currency still trails the dollar, euro and pound. The greenback’s share of total global payments, meanwhile, far exceeds its rivals, holding relatively steady around 47% in recent months.

Swift’s data doesn’t encompass the entirety of the $7.5 trillion-per-day foreign-exchange market, but the report does shed light on the vast pools of currency flows that drive global trade over time.

When Swift first began tracking the yuan’s usage in 2010, its share of the global total was less than 0.1%. But China is increasingly carving out a role for its currency in global trade and finance, a push hastened by the levy of US sanctions against Russia. The yuan’s usage in Russian export payments, for example, surged in 2022, Bloomberg reported at the time.

Read more: China Takes Yuan Global to Repel Increasingly Weaponized Dollar

--With assistance from George Lei.

©2024 Bloomberg L.P.