Apr 26, 2024

US Megacaps to Lead Stock Rally Until Real Rates Bite, Says BofA

, Bloomberg News

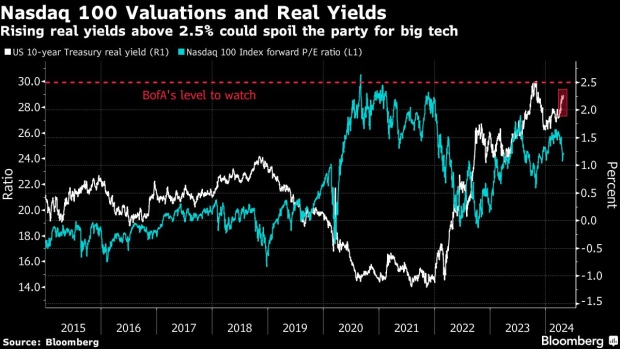

(Bloomberg) -- The US equity market will continue to rely on a handful of megacap stocks for direction until an uptick in real interest rates ignites recession fears, according to Bank of America Corp. strategists.

The team led by Michael Hartnett noted that the 10-largest US stocks combined have reached a record 34% of the S&P 500 Index market capitalization, while the top 10 global stocks have reached a record 23% of the MSCI All-Country Word Index’s.

That concentration will remain intact until real 10-year yields — rates adjusted to reflect the true cost of funds — rise to around 3%, “or higher yields combine with higher credit spreads to threaten recession,” the strategists wrote in a note. Elevated bond yields adjusted for inflation, seen as a proxy for tight financial conditions, are a common way for stock-market bubbles to burst.

Despite a turbulent April, the so-called Magnificent 7 — a group that includes Nvidia Corp., Apple Inc. and Amazon.com Inc. — have maintained a wide performance gap against the rest of the market since the start of the year.

Strong results from Microsoft Corp. and Alphabet Inc. on Thursday are expected to keep the big tech rally going. If Friday premarket gains hold, Alphabet is on track to take its market capitalization over $2 trillion, a historic threshold that has been elusive.

Read more: Bulls Back in Driver Seat After Microsoft and Alphabet Blowouts

Volatility returned to the stock market in April after a strong first quarter, as traders scaled back their bets that the Federal Reserve will cut rates this year, while the conflict in the Middle East pushed commodities prices higher, fueling inflation fears. Yet, stocks have shown resilience despite the US 10-year Treasury yield climbing to near-six month high, above 4.70%, amid data pointing to economic strength.

The market is currently positioned for a “no landing” scenario, the BofA strategists wrote — referring to bets that interest rates will stay higher for longer while economic growth remains strong. That would be positive for risk, especially cyclicals, they added.

However the risk of inflation accelerating would be negative for risk assets, trigger volatility and favor cash, gold and commodities, the strategists noted.

(Updates with Alphabet premarket move in par 5)

©2024 Bloomberg L.P.