Apr 26, 2024

UK Insolvencies Fall Back After Hitting Three-Decade High

, Bloomberg News

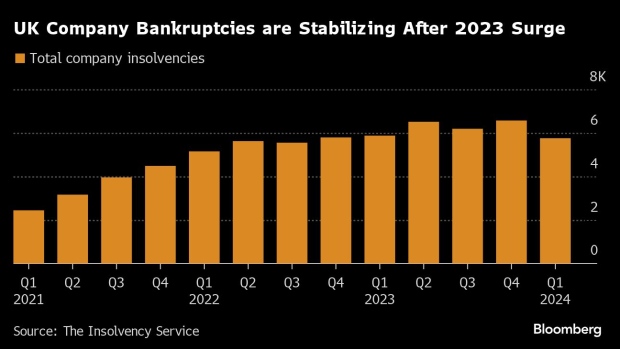

(Bloomberg) -- The number of English and Welsh companies going bust stabilized in the first quarter after hitting a three-decade high in 2023 following a hit to balance sheets from soaring energy bills and interest rates.

Company insolvencies in England and Wales fell 2% from a year ago to 5,759 in the first three months of the year, according to the government’s Insolvency Service. It was down 12% on the previous quarter.

The figures add to hopes that a rapid exit from the last year’s recession may strengthen companies that are now on the brink and prevent a repeat of last year’s jump to the highest level of insolvencies since 1993.

Falling inflation, the economy’s recovery and the prospect of cooling interest rates may begin to ease the pressure on UK companies in 2024.

However, it still leaves bankruptcies well above pre-pandemic levels with experts warning of more pain ahead for firms as many are forced to refinance their borrowings at high borrowing costs.

David Kelly, head of insolvency at PwC UK, said that 2024 will “remain a challenging year for many.”

“New measures effective from April 2024 introduce new hurdles for some businesses — with increased salary expenses, an approximate 6.7% increase in business rates, and additional costs associated with a transition to net zero,” he said.

Figures covering February, the latest available data, showed construction, retail and hospitality firms continued to bear the brunt of the bankruptcies.

©2024 Bloomberg L.P.