Apr 16, 2024

Turkey Central Bank Chief Sees Managing Expectations a Challenge

, Bloomberg News

(Bloomberg) -- Turkey faces a tradeoff between ensuring disinflation and rebuilding its international reserves, a dilemma the central bank governor said may sideline dollar purchases in favor of keeping a check on consumer prices.

“Our strategy going forward is that our utmost priority is disinflation and we will accumulate reserves as much as we can depending on market conditions,” central bank Governor Fatih Karahan said Tuesday.

Reversing a years-long drawdown of hard currency buffers was in focus following a dramatic policy shakeup after President Recep Tayyip Erdogan’s reelection last May, as part of an effort to win back the confidence of investors and rating companies.

But the effort harmed the local currency and resulted in more liras pumped into the economy, contributing to a pickup in inflation that’s on track to exceed 70% by May. The central bank’s gross reserves are down by nearly a third since December, reversing much of last year’s gains.

“We don’t want to be in a situation where we increase our reserves by a couple of billion dollars over a month or two but then lose out on the inflation goal,” Karahan said at a panel in Washington hosted by the Council on Foreign Relations.

Net reserves, excluding swaps with commercial lenders, are in negative territory and the central bank wants to improve that in the medium-term, according to Karahan, who’s in the US to attend the spring meetings of the International Monetary Fund and the World Bank.

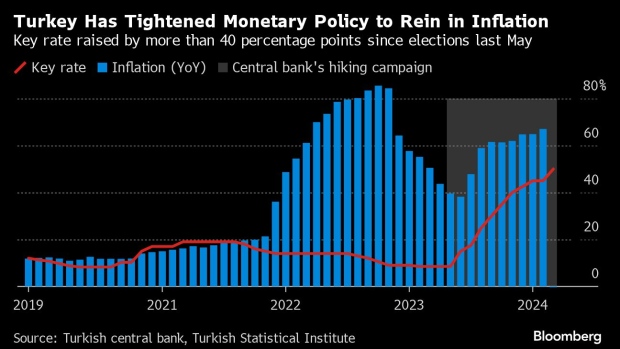

Karahan, who was elevated from deputy governor to governor in February, is placing less weight on replenishing reserves, saying it’s not been easy convincing markets of policymakers’ commitment to curb inflation. Since last June, Turkey’s benchmark interest rate was lifted by more than 40 percentage points to rein in inflation.

“We have done a lot and ready to do more to regain credibility and re-establish the policy rate as the primary tool,” Karahan said.

Karahan pointed to high demand and high inflation expectations as some of the main challenges. These are “making the investment climate not so favorable,” he said.

An aggressive tightening campaign that last saw the key rate raised to 50% in March is helping normalize demand, Karahan said, adding that the country is on track to reach its year-end inflation target of 36%. Markets, meanwhile, believe that the target will be achieved with a “three-month lag,” he said.

On the other hand, households’ expectations are more elevated and are “a lot less convinced” on policy action, according to Karahan. He said once headline inflation slows as of the summer months, that will support more savings in Turkish liras.

Turkey’s next rate-setting meeting is scheduled for April 25 and Karahan will present the latest inflation projections in May.

The central bank intends to borrow less from commercial lenders via swap transactions — a key source of hard currency for the monetary authority. The operations caused a liquidity problem and made it more difficult to maintain a tight policy stance, Karahan said.

“Now that the hiking cycle is over, we want to be on top of liquidity management” and banks don’t want to rely on swaps, he said.

©2024 Bloomberg L.P.