Apr 17, 2024

Tiny NJ Broker Behind Booming IPOs Is Back With 380% Blockbuster

, Bloomberg News

(Bloomberg) -- A little-known New Jersey brokerage that led the world’s wildest stock offerings just two years ago is back, this time with a Singaporean telehealth startup that went public last week and is now the year’s hottest US initial public offering.

Network 1 Financial Securities Inc., which operates out of Red Bank near the New Jersey shore, helped Mobile-Health Network Solutions raise $9 million last week, and the stock has soared 380% in its first few days of trading. It was the firm’s first sale of shares in a formerly private company since 2022, data compiled by Bloomberg show.

Representatives for Network 1 weren’t available to comment and Mobile-Health Network declined to comment on the stock move.

Mobile-Health Network Solutions touts itself as the “first pure-play telehealth company from APAC to list on a major US stock exchange.” It now has a market capitalization of around $650 million despite losing some $3.2 million in the fiscal year through June 30 on revenue of $7.9 million.

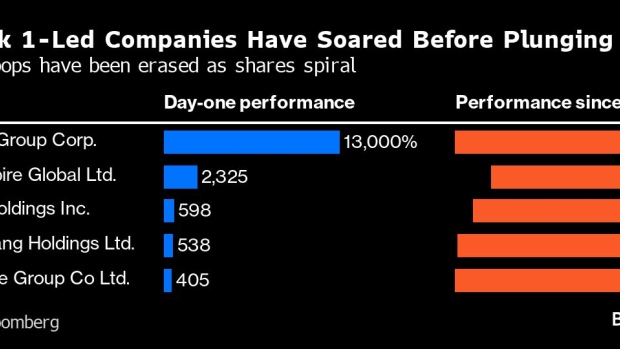

Network 1, which was founded in 1983, captured Wall Street’s attention in 2022 when tiny Chinese firms like garment maker Addentax Group Corp. saw their stock prices surge to points that on paper made them bigger than entire swaths of Corporate America — before plunging. That year, the IPOs it worked on soared nearly 2,000% on average during their first day of trading, Bloomberg calculations show.

Read more: Tiny NJ Broker Behind 2,000% IPOs Set to Return After Hiatus

Since then, Network 1 has been pretty quiet. Its last IPO was last summer for a Malaysian seller of chemical raw materials that went from the pink sheets to the Nasdaq Capital Market. The deal priced days after the stock jumped 179% in the lead up to the offering. And then, much like many of Network 1’s other offerings, the shares quickly plunged, erasing roughly 85% of their value in a matter of months.

Network 1 is a full-service broker/dealer and caters to clients including “high net worth individuals from many countries,” according to its website. The firm’s underwriting efforts have typically focused on Asian companies with a specialty Chinese investment banking practice. It has been listed on filings over recent months though those deals have yet to come to fruition.

Since 2020, the firm has been the banker for 20 deals with day-one surges ranging from Addentax’s 13,000% to a 48% plunge for Laser Photonics Corp. After those initial swings, all but three of Network 1’s blank-check firms (including Mobile-Health) have tumbled, with a median 92% drop from the IPO price, data compiled by Bloomberg show.

Big swings in tiny stocks are nothing new on Wall Street, especially when the portion of shares available to trade is a fraction of the overall share count. Mobile-Health Network Solutions’s manic rally comes at a time when speculators are flipping shares of so-called meme stocks like former president Donald Trump’s media company.

While the majority of former high-fliers, like GameStop Corp. or those that Network 1 took public, have plunged, traders who are brave enough to hang in can make a hefty profit or lose millions in the blink of an eye.

Network 1 has a history of run-ins with regulators that predate the booms and busts of the pandemic era. It paid fines for failing to detect suspicious transactions and insider trading, and it got dinged by regulators for not developing written anti-money laundering programs, Financial Industry Regulatory Authority’s records show.

©2024 Bloomberg L.P.