Apr 27, 2024

Telecom Tycoons Feel Pain From Rising Mobile Woes

, Bloomberg News

(Bloomberg) -- Billionaires who built their fortunes rolling out wireless networks when debt cost almost nothing are seeing their wealth crimped by higher borrowing costs and caution among money managers on the outlook for the industry.

Altice founder Patrick Drahi’s wealth has dropped almost 18% to $4.4 billion this year, according to the Bloomberg Billionaires Index, while Rakuten Group Inc.’s Hiroshi Mikitani’s fortune has shrunk 69% since 2021 after a push into mobile increased the firm’s losses. Charles Ergen has seen his riches shrink nearly 80% in less than three years as Dish Network Corp. tries to transition from pay-TV to wireless services.

A spokesperson for Altice declined to comment, while spokespeople for Rakuten and Dish didn’t reply to requests for comment.

The latest sting for the sector came this week when US underlying inflation numbers came in hotter than expected, leading traders to push back their expectations for a Federal Reserve rate cut to December. It’s a potential blow for operators who hoped to refinance borrowings at a lower cost this year.

Instead, wireless now trails only real estate as the biggest source of distressed debt globally after the pile swelled to $35.3 billion, according to data compiled by Bloomberg News. That’s up more than 80% since early January.

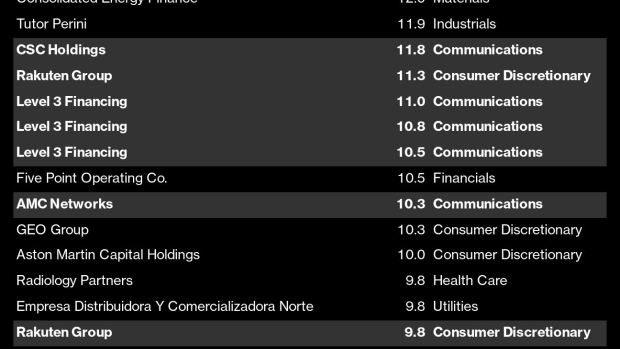

Annual returns from the industry’s junk bonds have also turned negative in the US as pricing shifts to reflect the realization that a monetary policy pivot is on hold for now. When operators do come to the market there, investors have been demanding high coupons, with six of the 10 costliest high-yield deals this year issued by firms with links to mobile.

The stumbles in wireless highlight wider troubles across telecommunications, media and technology. Communications is the worst-performing junk sector in the US this year, Bloomberg Intelligence credit analyst Stephen Flynn wrote in a note this week, with several members of the index burdened with high leverage and facing large maturity walls.

Drahi’s Altice group has been the poster child for the industry’s travails recently. Last month, the businessman’s lieutenants told creditors of its French operations that they would have to take a hit in the restructuring of the €24.3 billion debt pile. The fall in the firm’s bond prices since then helped send the total level of distressed debt globally last week to the highest level since the middle of January.

The French telecom is “teetering like a Jenga tower with unsustainable leverage and negative free cash flow,” Bloomberg Intelligence analyst Aidan Cheslin told the Credit Edge podcast.

Click here to listen to the Credit Edge podcast on Altice’s ‘Jenga Tower’

Any move to give lenders a haircut would follow in the footsteps of Digicel, the Caribbean mobile operator founded by Irish businessman Denis O’Brien. The firm imposed losses on bondholders and lenders earlier this year via what ratings company Moody’s described as a “distressed exchange.”

Dish Debt

Ergen’s Dish has been searching for ways to address upcoming debt maturities after scrapping a debt swap earlier this year when bondholders pushed back on the deal. Private credit firms have offered financing, Bloomberg News previously reported.

Meanwhile, Mikitani’s Rakuten announced earlier this month that it was looking at combining its financial units into a single group.

That “could raise funds to cover its large bond maturities in 2025,” Bloomberg Intelligence credit analyst Sharon Chen wrote in a note this week. However, “a reduced stake in fintech leaves it more exposed to the unprofitable mobile business.”

Week in Review

- Strong global demand for high-grade corporate debt and a slowdown in issuance are protecting investors from the worst of the volatility that is engulfing bond markets.

- As investors seeking safer bets clamor for asset-backed securities, Wall Street is turning to increasingly unconventional debt to package into the bonds, including art loans and internet addresses.

- Wells Fargo & Co. is looking at essentially buying insurance on some of the loans in its portfolio using a transaction known as a synthetic risk transfer, ahead of looming changes to capital rules. Separately, JPMorgan Chase & Co. is also sounding out investors about a pair of large synthetic risk transfer deals.

- UBS Group AG shareholders voted on a change that will make the bank’s recently-issued Additional Tier 1 bonds convertible, moving away from a feature that wiped out Credit Suisse investors last year.

- Companies refinancing in Europe’s hot high-yield bond market are increasingly opting to tender notes at below-par prices, a move that can push out maturities and save cash — but risks irritating investors.

- Citigroup Inc. and Wells Fargo & Co. are preparing a $2 billion debt package to support Berry Global Group Inc.’s spinoff of the majority of its health, hygiene and specialties business with Glatfelter Corp.

- Thoma Bravo is backing its acquisition of UK cybersecurity company Darktrace Plc with a debt package of over $2 billion.

- Blue Owl Capital Inc. is the sole lender on a £1.2 billion ($1.5 billion) debt package to help fund the acquisition of a majority stake in Audiotonix, in a win for private credit over its traditional bank rivals.

- Banks including Morgan Stanley and Goldman Sachs Group Inc. are lining up nearly €1 billion ($1.1 billion) of debt financing that will allow CVC Capital Partners to hold on to Multiversity, one of its university investments.

- Goldman Sachs Group Inc. has held conversations with private credit lenders to help shore up Beyond Meat Inc.’s liquidity.

- TGI Fridays is working with Guggenheim Partners to explore ways to address its debt as the restaurant chain contends with weakening sales.

- Creditors to Adler Group SA are set to take control of the company after the embattled landlord struggled to sell assets and repay debts against the backdrop of plunging prices.

- Commercial real estate was one of the scariest assets in the US last year. This year, investors are warming to it once again — and that’s helped revive a key property debt market.

- The debt crisis at Thames Water is jeopardizing £100 billion ($125 billion) of potential investment required over the next five years to mend Britain’s crumbling utilities infrastructure.

- Korean borrowers are selling an unprecedented amount of dollar bonds, overtaking Chinese peers to lead Asia’s primary market issuance for such debt.

- The weakening rupiah and a surprise rate hike are weighing on Indonesian companies that are facing a wall of maturing dollar debt.

- Novaland Investment Group, among Vietnam’s largest real estate developers, is planning to sell shares and increase borrowings after securing bondholders’ approval to restructure $300 million of notes to address a liquidity crunch.

On the Move

- Edward Bayliss, co-head of global credit trading at Morgan Stanley, is leaving to run Deutsche Bank AG’s US credit trading desk.

- Blackstone Inc. is recruiting Dan Leiter from Morgan Stanley as head of international in its newly formed credit and insurance division, while Michael Carruthers, a senior managing director at Blackstone, will become head of European private credit.

- Cheyne Capital has hired Frank Benhamou, former head of capital and structured funding solutions at Barclays Plc, as the alternative investment firm plans a $2 billion synthetic risk transfer strategy.

- SMBC Nikko Securities America Inc. is expanding its sales and trading team in the Americas, the latest in a raft of hires as the Japanese lender chases greater market share.

- Bank of Montreal hired Leerink Partners senior managing director Spencer Alstodt, who has structured, originated and syndicated leveraged loans and bonds for technology companies.

- Silver Point Capital recruited Charles Brockett from Goldman Sachs Group Inc. as a managing director on its capital markets team.

- Cantor Fitzgerald hired former B. Riley Financial Inc. bankers Tim Bottrell and Travis Hogan as managing directors for its new alternative capital solutions group.

- Moelis & Co. tapped Ankit Dalal, who previously worked at Evercore Inc., to bolster its debt restructuring practice.

--With assistance from Ben Stupples and Helene Durand.

©2024 Bloomberg L.P.