Apr 8, 2024

Solar stocks: the future looks bright, but make sure you wear your shades to reduce risk

By Larry Berman

Larry Berman's Educational Segment

“The Sun is not more dangerous during the eclipse — what is dangerous is our curiosity to look at it for longer.”

When the TAN (Invesco Solar) ETF hit the market in 2008, there was lots of excitement. Unfortunately for investors, disruptive technologies are not always winners out of the gate. Hydrogen fuel cell technology was expected to be huge 25 years ago and today the sector still struggles to be profitable. I’m a huge advocate for a sustainable future and solar and clean energy in general is likely to be a major growth area, but we think the story is measured in decades and while markets will go into speculative excitement period like we saw last with the Biden victory in the 2020 election and the subsequent Inflation Reduction Act (LMFAO), the sector still has major challenges.

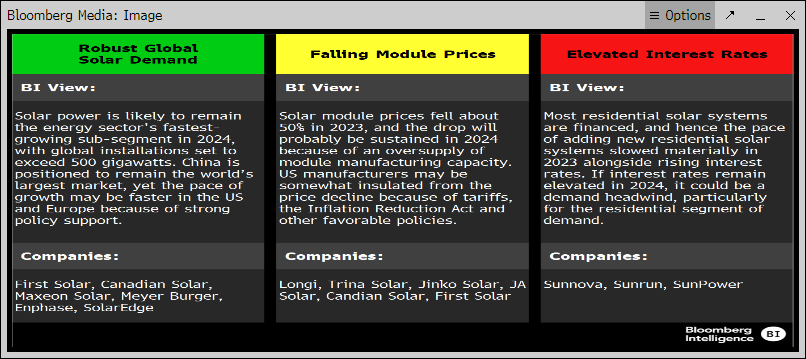

According to the research team at Bloomberg Intelligence, robust global demand should benefit many of the companies in the industry (FSLR, CSIQ, MAXN, MBTN, ENPH, SEDG), but over capacity built in recent years is forcing solar module prices down. While this is a positive for the industry overall, it does impact the companies that have more leverage to OEM manufacturing profitability (FSLR, CSIQ, JKS, 688599, 002459). Negatives are higher financing costs as the vast majority of instals are financed (NOVA, RUN, SPWR).

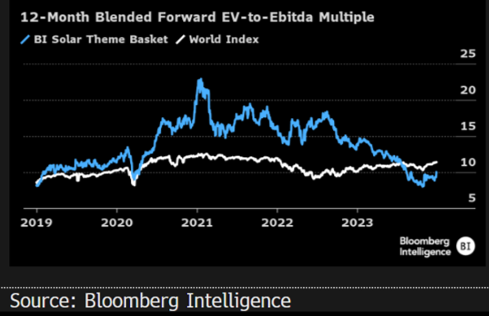

In terms of risks, the sector is now cheap to broad equity market valuations. The biggest catalyst might be a Trump Win in 2024 that could pull some of the support for green energy sectors.

“Solar stocks are not dangerous to hold in your portfolio—what is dangerous is buying them at the wrong time.”

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com