Apr 19, 2024

Slovakia Ventures Beyond Euro Bonds for First Time in Decade

, Bloomberg News

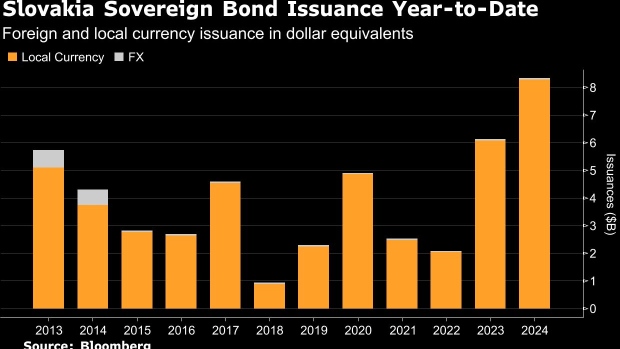

(Bloomberg) -- Slovakia tapped a debt market beyond its own euro region for the first time in a decade and plans further issuance in Swiss francs and possibly the dollar, the head of the nation’s debt agency said.

Facing growing financing needs and rising yields on its core euro-denominated bonds, the east European nation sold a total of 635 million francs ($699 million) in 4-year and 10-year notes on Thursday, paying 45 and 70 basis points over mid-swaps, according to a statement.

The Swiss market is “perfectly suited” for Slovakia since 80% of its buyers don’t typically purchase the east European nation’s euro bonds, debt chief Daniel Bytcanek told Bloomberg. In fact, this was the first franc debt sale by foreign government since 2015, he said.

“In the coming years, we would like to return to the Swiss market for diversification, and we still have in mind returning to the US market, which is being considered next year,” Bytcanek said on Friday.

The yield on the country’s benchmark 10-year euro note has increased nearly 50 basis points this year to 3.7% as Slovakia faces a mounting budget shortfall. Repayments and projected deficits for the current and forthcoming years are estimated at €10 billion ($10.6 billion) annually. The strains stem primarily from new social spending approved by both prior administrations and the current government led by Robert Fico.

Furthermore, Bytcanek said the search for new bondholders comes as Slovak bonds held by the European Central Bank — as part of its quantitative easing programs — are maturing. “As portions of our bonds held by the ECB are gradually maturing, we need to find new investors.”

A euro zone member since 2009, Slovakia last sold bonds in other currencies in 2014 before abandoning such issuance due to cheap financing conditions in the monetary union. This year, the nation of 5.4 million people is poised to record the highest budget deficit in the European Union, projected by the government at 6% of economic output.

In an effort to allay investor concerns, Fico pledged to unveil a deficit reduction package of €1.4 billion, equivalent to 1% of output, for next year. However, only partial measures have been presented so far.

“We still live off our long-established good image as a reputable issuer,” Bytcanek said. “But the market awaits the decisions on the deficit reduction package that the government must deliver.”

--With assistance from Peter Laca.

©2024 Bloomberg L.P.