Apr 18, 2024

More Economists See BOJ Rate Hike in October, Flag July Risk

, Bloomberg News

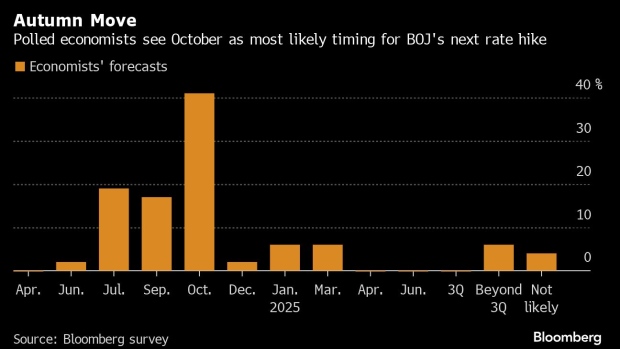

(Bloomberg) -- An increasing number of economists expects the Bank of Japan to raise interest rates again in October after it stands pat next week, with most of them flagging an earlier move in July as a risk scenario, according to a Bloomberg survey.

All 54 economists except for one predict no policy change at the central bank’s two-day meeting ending on April 26, following last month’s decision to push up rates for the first time since 2007 and call time on a massive monetary stimulus program.

Some 41% of respondents forecast October to be the timing for the BOJ’s next rate increase. That figure is up from 26% in a survey conducted a few days after the March 18-19 meeting. The proportion of those predicting a July move as their main scenario dropped to 19% from just under a quarter in late March.

Still, with some 70% of the polled BOJ watchers seeing a risk of the BOJ needing to raise rates due to a weak yen, they are attentive to whether the bank may act earlier or give hawkish signals to try and stem further declines in the currency.

“The meeting this time is to discern the impact of the policy changes,” Naoya Hasegawa, chief bond strategist at Okasan Securities Co., wrote in the survey. “I expect the next rate hike in October once they’ve been able to confirm an improvement in consumer spending and sentiment due to higher pay and a tax rebate.”

For the full results, click here.

In a media interview earlier this month, Governor Kazuo Ueda hinted at a chance of a rate hike in the second half of this year by highlighting the likelihood of improvement in the price trend. The recent acceleration in the yen’s depreciation may push that timeline forward, according to the economists.

The yen hit a fresh 34-year low this week with the market focusing on rate differentials with the US. Weakness in the currency has prompted leaders of Japan’s three biggest business lobbies to express concern, a sign of a possible shift in perceptions. The weak yen has helped corporate profits stay near a record high, but it’s also driving up costs of imported materials.

The US, Japan and South Korea issued a joint statement overnight that acknowledged concern in Tokyo and Seoul over recent depreciation of their currencies, following a meeting of their finance ministers with Treasury Secretary Janet Yellen. The statement will fuel speculation that Japan may intervene in the currency market if the yen slides further.

“The BOJ doesn’t have to rush its next rate hike so I expect it in October,” Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp., wrote in a response to the survey. “The risk is foreign exchange. They may have to consider an earlier hike if the yen drops further, as that would impact inflation.”

Another key factor for gauging the likely timing and pace of rate hikes is the BOJ’s quarterly economic report. The BOJ is widely expected to raise its inflation projections after it cited the price goal coming into sight as a reason for raising rates in March.

An updated forecast for consumer prices excluding fresh food will likely be revised higher to 2.6% from 2.4% for the fiscal year that started this month, according to the survey. BOJ’s first forecast for fiscal 2026 will probably be 2%, the survey showed.

Given the high likelihood of upgraded price forecasts, three quarters of analysts said the BOJ’s characterization of the risks for its inflation view is more important than usual. The bank said risks for prices are “generally balanced” in the previous report in January.

“The key question is how it describes risks to its inflation outlook,” said Marcel Thieliant, head of Asia-Pacific at Capital Economics. “Ueda has argued that the Bank would want to tighten policy further if there’s a risk of inflation overshooting the target, so if the Bank did see upside risks, that would open the door to further rate hikes.”

©2024 Bloomberg L.P.