Apr 15, 2024

Jittery Investors Snap Up Options Across Markets

, Bloomberg News

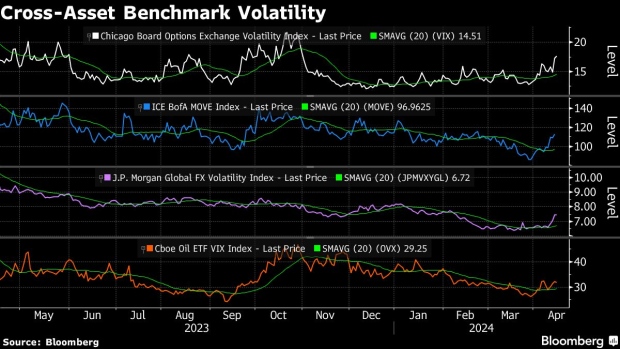

(Bloomberg) -- Volatility is perking up across markets as investors seek protection amid concern that the conflict in the Middle East could widen and as the selloff in the bond market deepened.

The premium for one-month put options to protect against a pullback in US equities reached the highest since October. At the same time, currency-options volatility is climbing from multiyear lows. A key gauge jumped to levels last seen in January as strong US economic data leads traders to trim the degree of Federal Reserve interest-rate cuts expected this year, driving up Treasury yields as well.

In commodities, oil flipped from a put to a call premium this month for the first time since November amid the conflict between Iran and Israel while OPEC+ output cuts boosted Brent crude above $90 a barrel. A record number of Brent call options traded last week with markets on edge ahead of Iran’s attack over the weekend, and was on pace for a daily record Monday. The premium for calls rose to the highest since October, after retreating early Monday after Israel didn’t immediately retaliate.

It all shows that with questions swirling on multiple fronts, investors are starting to prepare for an end to the period of relative calm that held in markets over the past few months.

“There was clearly a fear of the weekend gap risk given the geopolitical headlines,” said Tanvir Sandhu, Bloomberg Intelligence’s chief global derivatives strategist, referring to cross-asset volatility at the end of last week. “There has been some relief given the lack of further escalation, but the geopolitical situation remains uncertain.”

- Read more from Bloomberg Intelligence

The skew on the VIX index — which measures volatility on the S&P 500 — has shown growing demand for calls as traders position for protection. For one-month options, the skew is the highest since October.

In another sign investors are seeking havens, the dollar and gold are strengthening. Three-month implied volatility on the SPDR Gold Shares ETF, which tracks bullion prices, reached the highest in almost a year with the metal repeatedly hitting record highs this month. Meanwhile, a JPMorgan currency volatility index reached the highest in months.

BI LATEST RESEARCH:

- Economic Outlook Erodes the Left Tail of SOFR Options Pricing

- FX Volatility Clustering Keeps the Focus on Carry, for Now

- 0DTEs, Volatility Forum 2024 Part II: All Options Considered

TOP NEWS:

- US Yields Spike as S&P 500 Trims Gains by Half: Markets Wrap

- Iran’s Attack on Israel Sparks Race to Avert a Full-Blown War

- Bullish Oil Options Traded at Record Pace Before Iran Attack

EQUITIES

Top Technology Large-Cap open interest changes as of Friday:

CROSS-ASSET VOLATILITY:

KEY CHARTS:

- One-month vs 3-month S&P 500 implied volatility reached the narrowest gap since late October as investors sought hedges against short-term swings

- The ratio of the Nasdaq 100 volatility index to the S&P VIX also fell to the lowest level since that time, as hedging interest appeared to be focused on the broader market.

- India’s Nifty 50 index 3-month implied volatility fell below the S&P 500 for the first time since December, while the Stoxx 50 volatility trended higher along with the S&P. The 3-month 90%-110% skews on all the indexes moved higher as hedging interest grew, though still remains below historical norms.

EQUITIES OPTIONS WRAPS:

- VIX Hits Highest Since October; Delta Calls: Options Snapshot

- POSCO Future M, SK Bioscience: South Korea Options Wrap

- Shree Cement, Eicher, UltraTech Cement: India Options Wrap

- SMIC, HK & China Gas, Wuxi Biologics: Hong Kong Options Wrap

COMMODITIES

- Brent crude oil 2nd-month 25-delta call skew is near the highest level since late October even as prices slipped back from last week’s highs, as concern over the possibility of a broader Middle East conflict adds to existing bullishness from reduced OPEC+ supplies.

- US and Europe natural gas implied volatility remained muted, though European markets pushed a bit higher given supply risks from a broader Middle East conflict. US markets remain in the doldrums, with producers restraining production in the face of spot prices in some basins falling below zero.

Commodities positioning:

- OIL BAROMETERS: Brent Call Volumes Hit Weekly Record; Bull Bets

- METAL BAROMETERS: Overbought Spot Gold Prone to Some Correction

- CFTC Money Managers’ Commodity Positions for April 9 (Table)

RATES/FX

- Currency option turnover remains elevated, with Middle East tensions stoking dollar call buying. Volumes are running above the recent daily average with euro-dollar turnover leading peers, according to DTCC.

- Rates volatility has surged since the middle of last week, shown by the ATM 3 month-10 year swaption rising to highest levels since January. The move has been supported by flows in Treasury futures targeting higher yields over the coming weeks as the strong US growth narrative builds, along with the further pricing out of Fed rate cuts. Despite this, flows in SOFR futures have been skewed toward fading the move higher in volatility through various straddle and strangle sales.

FX/RATES positioning and wraps:

- Currency Volatility Is Back as Geopolitics Add to Dollar Bets

- $8.5 Million Straddle Play Looks to Fade 3-Day Jump in Rates Vol

- Option Turnover Still Hot as Inflation, War Risk Lifts Greenback

- A $4.4 Million Options Wager Targets 10-Year Yield Rise to 4.65%

ECO CALENDAR

- April 16

- US March Housing Starts, m/m, est. -2.4%, prior 10.7%

- April 17

- EC March final CPI y/y, est. 2.4%, prior 2.4%

- April 18

- US Initial Jobless Claims, est. 215k, prior 211k

--With assistance from Edward Bolingbroke and Robert Fullem.

(Updates first chart, Brent volumes in third paragraph)

©2024 Bloomberg L.P.