Apr 25, 2024

Japan Is Ready to Intervene Even as BOJ Meets, History Shows

, Bloomberg News

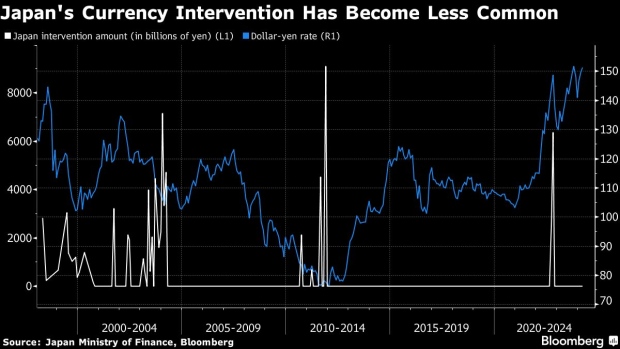

(Bloomberg) -- History suggests that Japanese authorities are willing to intervene in the currency market even around the time that the central bank’s policy board is meeting.

From 2003 to 2004, currency authorities sold yen for dollars on at least one day on nine Bank of Japan policy meetings, Ministry of Finance data show. Japan also conducted such intervention on BOJ meeting days once each in 1999, 2000 and 2002.

For action to buy yen against the dollar, Japan stepped into the market on April 9, 1998 and Sept. 22, 2022 when the BOJ was meeting. The Ministry of Finance sets foreign-exchange policy in Japan, and while its officials won’t want to take market action that runs contrary to the BOJ’s monetary policy, the fact that board members were debating policy hasn’t stopped them from ordering intervention in the past.

©2024 Bloomberg L.P.