Apr 27, 2024

Hedge Funds Trim Bets on Oil as US Economic Data Restrain Prices

, Bloomberg News

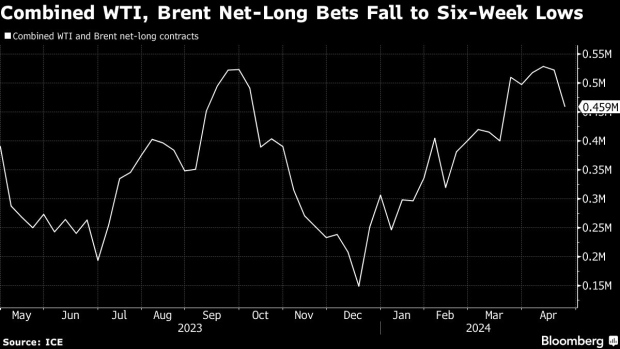

(Bloomberg) -- Hedge funds trimmed bets on Brent and West Texas Intermediate crude as a relatively quiet week in the Middle East and weak US economic data weigh on prices.

Money managers trimmed their net-long positions on the two grades by 63,403 lots to 459,273 lots in the week ending April 23, a six-week low, according to weekly ICE Futures Europe and CFTC Futures data. While Israel launched a strike on Iran that week, Iran’s media downplayed the effect of attack, reducing crude’s geopolitical risk premium.

Meanwhile, in the US, inflation is sticking around, which means that the Federal Reserve may maintain higher interest rates as it continues to fight hot prices. The weakness in the US economy has created a risk-off mood that has restrained oil markets — though both WTI and Brent were able to end Friday’s session with slight gains.

©2024 Bloomberg L.P.