Apr 17, 2024

Crypto.com’s Venture Unit Is Wary of Bloated Industry Valuations

, Bloomberg News

(Bloomberg) -- Crypto.com’s venture capital arm is dubious about the sustainability of surging valuations in the sector, the digital-asset exchange’s Chief Executive Officer Kris Marszalek said.

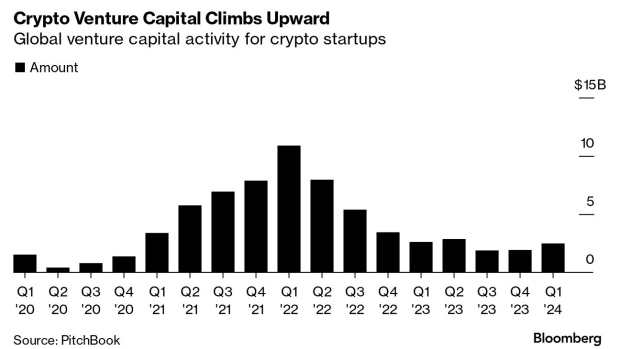

His observations come amid a notable pickup in billion-dollar funding rounds for early-stage crypto startups following the latest rally in virtual currencies. The deals are a reminder of the investment frenzy that accompanied the pandemic-era bull run in tokens, with very mixed results.

“We want the financial return,” Marszalek said in an interview Tuesday. “At this moment, valuations being thrown around by project teams are very generous.”

Crypto.com Capital — which had $500 million to invest in startups in the sector as of January 2022 — has scaled back its investment activity over the past 18 months. Analysts at Dealroom recorded just four Crypto.com investments since the start of 2023, based on publicly available information, compared with 35 in the two years prior to that period.

Scaling Back

The fund looked “to scale back a little bit” even as exuberance returned in crypto venturing, Marszalek said. “We try to be reasonable on this,” he added. The unit has made about 70 investments to date, deploying a nine-figure sum, according to Marszalek, who declined to provide an exact figure.

Across the industry as a whole, recent venture capital deals include Berachain, a blockchain operated by pseudonymous founders sporting bear-themed avatars. The project bagged $100 million at a valuation of at least $1 billion.

Merkle Manufactory — the software firm behind decentralized social-media network Farcaster — and blockchain developer Monad Labs have also clinched billion-dollar valuations in the past few weeks, according to reports.

Crypto.com Capital participated in Berachain’s raise, Marszalek said, as well as a $17 million raise by staking firm Kiln and a $4.8 million investment in gaming startup Arcade2Earn. The venture arm targets seed-stage and Series A rounds.

Some of the limited partners that provide capital for venture funds are, like Marszalek, wary of the hype bubbling back into the industry. LPs are reluctant to pour in more money until venture funds start producing tangible returns.

©2024 Bloomberg L.P.