Apr 15, 2024

China Reports Surprisingly Strong Growth Driven by Industry

, Bloomberg News

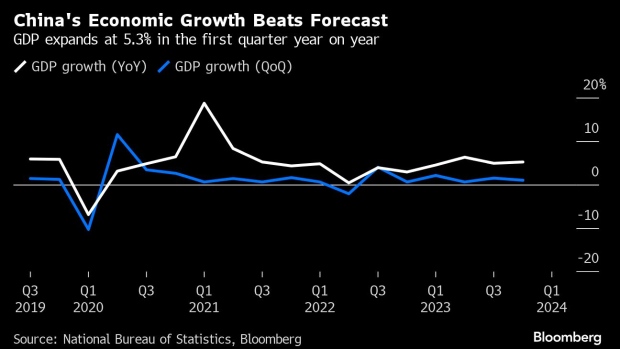

(Bloomberg) -- China reported faster-than-expected economic growth in the first quarter – along with some numbers that suggest things are set to get tougher in the rest of the year.

Gross domestic product climbed 5.3% in the period, accelerating slightly from the previous quarter and beating estimates. But much of the bounce came in the first two months of the year. In March, growth in retail sales slumped and industrial output fell short of forecasts, suggesting challenges on the horizon.

“Markets may find it hard to be convinced by the strong GDP growth print and difficult to reconcile with the mixed March data,” said Xiaojia Zhi, chief China economist at Credit Agricole. “There could be also concerns that if GDP growth remains above 5% as data suggest, policymakers would be quite comfortable and see no pressure to further ease their policies.”

The world’s second-largest economy has struggled to find a firm footing post-pandemic. Manufacturing is holding up, thanks to overseas demand and Beijing’s focus on developing advanced technologies at home. But a prolonged real estate crisis is weighing on confidence, factory prices have been in decline for more than a year and a broad measure based on Tuesday’s data showed the economy slipping deeper into deflation — all reflecting anemic domestic demand, as well as excess capacity in some industries.

The yuan narrowed earlier losses to trade 0.2% weaker in the offshore market, after the People’s Bank of China loosened its grip on the currency earlier on Tuesday. The yield on the 10-year benchmark government bond was little changed at 2.28%. .

What Bloomberg Economics Says ...

The surprise acceleration in China’s first-quarter growth puts GDP on an early track for this year’s 5% target. The details, though, raise serious doubts about sustainability. The pickup was almost entirely driven by public investment ... Under-performance in production and private demand suggest the recovery is on thin ice.

— Chang Shu, Chief Asia Economist

Read more here

Economists at Australia & New Zealand Banking Group Ltd and DBS Group Holdings Ltd raised their forecast for China’s annual growth to 4.9% and 5% respectively after the National Bureau of Statistics released the data, bringing those numbers in line with the government’s annual target. Nathan Chow, senior economist at DBS, cited stronger-than-expected US demand and an improving labor market as reasons for the upgrade. The urban jobless rate eased slightly last month.

But doubts over the economy’s momentum added to angst over elevated US interest rates and tensions in the Middle East. A gauge of regional stocks in Asia on Tuesday tumbled the most since August, and a global index of emerging market currencies dropped, with South Korea’s won and the Indonesia rupiah weakening to multi-year lows.

Data published Tuesday also highlighted the recovery’s unevenness. Cement output plunged 22% in March, the largest drop since records began in 1995, highlighting the impact of the housing slump. On the other hand, production of integrated circuits and new-energy vehicles — considered China’s key new economic drivers — both maintained rapid growth at a pace around 30%.

Falling growth in restaurant spending and declining automobile sales show consumer demand remains weak in contrast with strong investment, led by state-owned companies. China’s elevated savings rate is another sign of household caution.

The two-speed growth model carries its own risks. China’s manufacturing drive has exacerbated tensions with trading partners, with US Treasury Secretary Janet Yellen and German Chancellor Olaf Scholz both traveling to China this month to scold officials on what they see as a deluge of cheap exports.

Data released Tuesday showed China’s factories used less of their potential in the first quarter than at any time since the pandemic, giving credence to complaints over excess capacity.

The National Bureau of Statistics said the economy “got off to a good start” in the first quarter but cautioned on external risks. “The complexity, severity and uncertainty of the external environment are on the rise,” the NBS said in a statement accompanying the Tuesday release. “The foundation for economic stabilization is not yet solid.”

Most economists agreed the latest numbers suggest the government’s growth goal of about 5% is well within reach. But they warned policymakers still need to take more action to stabilize the property market and encourage consumers to spend. Attention will now shift to a meeting of the Politburo — China’s top leadership body — to set economic policy, which typically happens in late April.

One risk is that surprisingly strong first-quarter growth may not only reduce the prospects of additional fiscal stimulus, but also lead officials to conclude they don’t need to implement already planned measures.

“The pace of execution of policies set during the Two Sessions may be affected” if policymakers feel they can now lie back, said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc, referring to the annual parliamentary session in March. The government has yet to release a clear plan for issuing the ultra-long special sovereign bonds, a major fiscal tool this year to shore up domestic demand, he said.

Monetary policy support is likely to be constrained by the strong US economy. With an imminent Federal Reserve interest-rate cut looking less likely, the chances of China’s central bank easing rates is also “diminishing,” according to Zhiwei Zhang, president and chief economist at Pinpoint Asset Management.

--With assistance from Winnie Hsu, Iris Ouyang, Rebecca Choong Wilkins, Josh Xiao, Wenjin Lv and Tom Hancock.

(Updates with more details and context)

©2024 Bloomberg L.P.