Apr 15, 2024

CATL First-Quarter Net Rises as Battery Dominance Pays Dividends

, Bloomberg News

(Bloomberg) -- Contemporary Amperex Technology Co. Ltd.’s first-quarter profit rose as its dominance supplying electric-vehicle batteries offset weakening overall car sales.

Net income climbed 7% to 10.51 billion yuan ($1.5 billion) in the period, CATL said Monday. The manufacturer’s gross margin reached the highest since the third quarter of 2021. Shares in CATL climbed as much as 1.1% on Tuesday.

As supplier to major automakers including Tesla Inc., Volkswagen AG and Toyota Motor Corp., CATL plays a key role in China’s grip on the global EV supply chain. The company has vowed to keep expanding in the face of cooling demand for battery-powered cars.

The robust results suggest that CATL due to its leading technology and scale has “better-than-expected cost control,” said Joanna Chen, an analyst at Bloomberg Intelligence. The first quarter usually is the weakest period for auto sales in China because of the Lunar New Year holiday.

Morgan Stanley raised its price target on CATL by 4.5% to 230 yuan a share, with analysts led by Jack Lu citing the company’s outperformance in terms of its battery margins and its improving product mix and cost control. CATL stock in Shenzhen closed on Monday at 197 yuan. The shares are up about 20% this year.

In an interview last month, CATL founder and Chairman Robin Zeng said the company has no plans to slow down its expansion even as EV demand is cooling in parts of the world.

Zeng, worth $27.4 billion thanks to the success of CATL, dismissed overcapacity fears and said he plans to increase output — particularly for the cell maker’s more cutting-edge batteries offering longer range or better durability in extreme weather conditions.

What Bloomberg Intelligence Says

CATL’s 10.5 billion-yuan 1Q profit beats our scenario by more than 10%, and its sequential margin expansion during a typically slow season suggests better-than-expected cost control — likely bolstered by its technology edge and peer-beating scale. Earnings appear resilient even as the battery industry battles rising competition and price pressure.

- Joanna Chen, BI auto industry analyst

Click here for the research

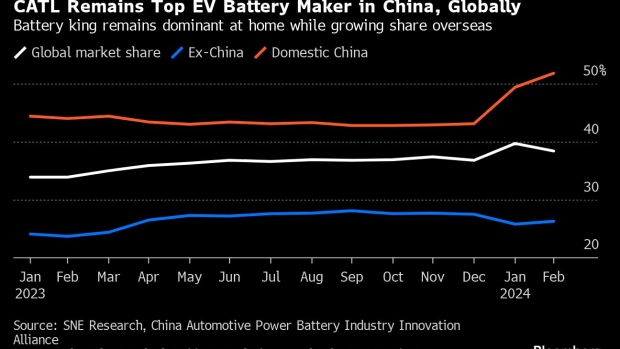

CATL is fairing better than rival LG Energy Solution Ltd., and commands a 38.4% global market share to its second placed rival with a distant 13.7%, SNE Research data shows. The South Korean battery maker earlier this month said first-quarter operating profit fell 39%, and if it wasn’t for a tax credit stemming from the US Inflation Reduction Act — President Joe Biden’s signature climate law — it would have lost money.

The Chinese manufacturer’s first-quarter revenue slipped 10% to 79.77 billion yuan. Its net profit was broadly in line with analyst estimates.

Tumbling raw material prices such as lithium carbonate and nickel have also weighed on battery makers, factoring into a wider industry discounting war that’s spread across cell and EV makers alike.

Ningde, Fujian-based CATL’s leadership not only in China but also abroad gives it stronger pricing power to defend against more price-sensitive margins domestically.

--With assistance from Charlotte Yang.

(Updates share moves in 2nd paragraph.)

©2024 Bloomberg L.P.