Apr 24, 2024

Abu Dhabi Raises $5 Billion With First Eurobond in Three Years

, Bloomberg News

(Bloomberg) -- Abu Dhabi sold its first eurobonds since 2021, raising $5 billion in one of the biggest deals from emerging markets this year.

The oil-rich sheikhdom, the capital of the United Arab Emirates, issued tranches five, 10 and 30 years. The final yields were significantly tighter than the guidance from when the sale started on Tuesday morning, suggesting there was plenty of demand from investors.

Emerging market governments have sold almost $100 billion of dollar- and euro-denominated bonds in 2024, setting it up to be one of the busiest years on record, according to data compiled by Bloomberg.

A recent shift in global interest-rate expectations — with traders now expecting fewer cuts from the US Federal Reserve this year as progress on slowing inflation stalls — has pushed borrowing costs higher for dollar issuers.

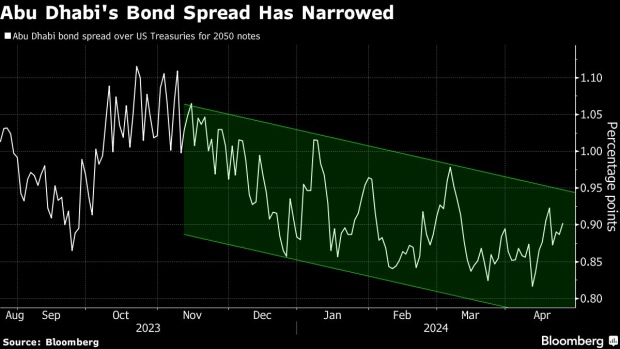

Still, Abu Dhabi is rated AA by S&P Global Ratings, the same as the UK, France and Qatar, allowing it to come to the market without much of an impact on its borrowing costs.

Click here for full details on Abu Dhabi’s bonds

The five-year portion of $1.75 billion was priced 35 basis points over US Treasuries, giving it a yield of 4.97%. The initial guidance was 70 basis points. The longest tranche, also $1.75 billion, had a spread of 90 basis points and a yield of 5.62%.

Though Abu Dhabi’s strong finances suggest it “doesn’t need the money,” the offering allows it to deepen its presence in the market, Mehdi Popotte, a senior portfolio manager at Arqaam Capital, said before the final terms were announced.

The deal will “pave the way for Abu Dhabi’s government-related entities to issue further later this year,” he said.

Abu Dhabi Commercial Bank PJSC, Citigroup Inc., First Abu Dhabi Bank PJSC, HSBC Holdings Plc, JPMorgan Chase & Co., Morgan Stanley and Standard Chartered Plc managed the bond sale.

©2024 Bloomberg L.P.