Apr 25, 2024

Tokyo Inflation Slows Sharply on Education Subsidy Impact

, Bloomberg News

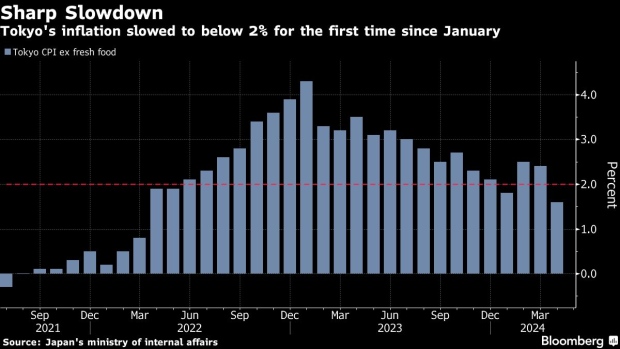

(Bloomberg) -- Price growth in Tokyo decelerated sharply to a pace below 2% in April, in an outcome largely distorted by the start of education subsidies, as the Bank of Japan gathers to decide policy.

Consumer prices excluding fresh food rose 1.6% in Tokyo, slowing from 2.4% in March, the ministry of internal affairs reported Friday. A deeper measure of the inflation trend that strips out fresh food and energy prices slowed to 1.8%, compared with the consensus estimate of 2.7%.

While the Tokyo CPI data are usually considered a leading indicator for national trends, the April figures were distorted by the start of the education subsidies. That impact won’t be mirrored across the country in nationwide data for April due to be released on May 24.

The metropolitan government made high school tuition free for all income groups and began providing subsidies to households with children attending private secondary schools. The sharp plunge in costs for public and private high schools shaved around half a percentage point from the overall figure, according to the ministry.

Yuichi Kodama, economist at Meiji Yasuda Research Institute, said the impact of the education subsidies was a one-off factor, but there were other signs of more sustained weakness in the data.

“Food inflation is coming down and we don’t see a noticeable spike in energy prices, which tells me that the weak yen has yet to have much impact on prices via higher imports,” Kodama said. “As inflation calms down and real wages turn positive, that may support consumption. But that’s different from a rise in underlying inflation the BOJ is aiming for.”

The data may inject some caution into the BOJ’s discussions, given that the slowdown was larger than expected even with the distortion. The bank is widely expected to keep its policy settings intact Friday, with some economists expecting authorities to add hawkish hints in order to buttress the yen.

The sharp slowdown in Tokyo inflation might complicate that scenario, though it probably won’t derail the BOJ from pursuing normalization. Kodama said the weak yen’s impact on prices would need to be more pronounced in order for that to prompt a BOJ hike. He sees July as the earliest possible timing for the next hike.

What Bloomberg Economics Says...

“ The weak CPI report will damp expectations on the policy board that underlying inflation is picking up its 2% target.”

—Taro Kimura, economist

Click here to read the full report

Among other drivers of Friday’s data were processed food, for which price growth slowed to 3.2%. Price growth for services slowed sharply to 0.8% from 2%. The central bank monitors that gauge as an indicator of broad price trends.

Attention will now shift to the BOJ. One focus will be the latest quarterly outlook, which will contain revised inflation forecasts for this fiscal year and next, and a new projection for the period beginning in April 2026.

At its meeting Friday, the bank will likely consider revising up its projection for the key inflation gauge for the current fiscal year from 2.4%, according to people familiar with the matter. The BOJ is also likely to newly forecast inflation of around 2% for the fiscal year starting April 2026, the sources said.

On the policy front, authorities will mull cutting purchases of government bonds, according to a report by Jiji. A reduction in such purchases would be seen as a dilution of the BOJ’s dovish stance.

With the bank having last month ended its zero rate policy with the first hike in 17 years, markets are now seeking clues on the timing for a second hike. Some 41% of respondents to a Bloomberg survey predicted the bank would next hike in October, with many flagging an earlier move in July as a risk scenario.

Authorities are also expected to discuss the weak yen and its impact on inflation trends. BOJ Governor Kazuo Ueda said in parliament earlier this month that he will monitor the impact of the weak yen on the economy and inflation dynamics, while ruling out a direct response to foreign exchange movements.

(Adds details from report)

©2024 Bloomberg L.P.