Apr 25, 2024

Intel Slides After Tepid Forecast Spurs Fears About Comeback

, Bloomberg News

(Bloomberg) -- Intel Corp., the biggest maker of personal computer processors, tumbled the most in three months on Friday after giving a lackluster forecast for the current period, indicating that it’s still struggling to return to the top tier of the chip industry.

Sales in the second quarter will be about $13 billion, the company said Thursday. That compares with an average analyst estimate of $13.6 billion, according to data compiled by Bloomberg. Profit will be 10 cents a share, minus certain items, versus a projection of 24 cents.

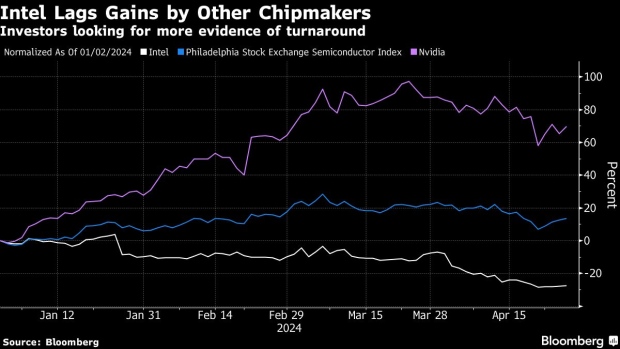

The outlook signals that a push by Chief Executive Officer Pat Gelsinger to revitalize Intel is going to take more time and money. Once the world’s dominant chipmaker, the company is lagging behind rivals such as Nvidia Corp. and Taiwan Semiconductor Manufacturing Co. in revenue and technological know-how.

Gelsinger remains confident that Intel is on the right track, both in the near term and the long run. He said the company is making headway in its effort to become a so-called foundry, a company that sells outsourced chip production to outside customers.

Demand is “a bit tepid in the first half, but we see a lot of improvement as we go through the year,” he said in an interview with Bloomberg Television. “We’re going to see progress in the foundry business every quarter from now until the end of the decade.”

Intel shares fell 9.2% to $31.88 at the close in New York, the biggest single-day decline since January. The stock had already declined 30% this year through the close on Thursday, making it the second-worst performer on the Philadelphia Stock Exchange Semiconductor Index.

In the first quarter, the Santa Clara, California-based company had a profit of 18 cents a share, excluding certain items, and revenue of $12.7 billion. Analysts had estimated a profit of 13 cents a share and sales of $12.7 billion.

While acknowledging that business has been slower than expected, Chief Financial Officer Dave Zinsner said he expected an improvement later this year. Intel also wasn’t able to meet all the demand for processors used in new AI-enabled PCs because its packaging facilities weren’t able to produce enough components.

“The first half of the year has been a bit softer than we’d have liked,” he said in an interview. “The back half of the year is going to have some pretty good strength in it.”

The chipmaker is reporting earnings for the first time under a new business structure that shows the financial performance of its manufacturing operations. Gelsinger has said the approach is a necessary step to make operations more efficient and competitive.

Read More: Intel Suffers Worst Decline in Two Months on Downbeat Outlook

Earlier this month, the company gave investors the first look at the financial state of its factory network. It wasn’t encouraging. Spending on new plants has caused losses to widen, and Intel doesn’t expect the business to reach a break-even point for several years.

Intel Foundry, the new division responsible for manufacturing, had sales of $18.9 billion in 2023, down from $27.5 billion the previous year. The unit had revenue of $4.4 billion in the first quarter of 2024.

The foundry business had an operating loss of about $2.5 billion in the first quarter, wider than the losses posted in the preceding quarter and the one a year earlier.

The company’s PC-related chip sales were $7.5 billion, compared with an average estimate of $7.4 billion. Its data center and AI division had revenue of $3 billion, in line with Wall Street projections. Networking chips provided nearly $1.4 billion of sales, beating an average estimate of $1.3 billion.

Gross margin — or the percentage of sales remaining after deducting the cost of production — was 45.1% in the quarter. That closely watched measure, which reflects the efficiency of Intel’s manufacturing operations, will be 43.5% in the current period. Historically Intel has posted margins of more than 60%.

Intel remains optimistic about the second half of the year because it’s rolling out a new version of the Gaudi chip — its answer to the red-hot AI accelerators sold by Nvidia. That product line will bring in about $500 million in sales this year, once the latest version goes on sale, Intel projected.

The company also is making progress at reining in costs and expects the manufacturing business to break even in the “next couple of years,” Zinsner said.

Gelsinger said the company has signed up another customer for a production technology called 18A, which Intel will introduce in 2025. That brings the total to six. The customer, which Intel didn’t identify, is in the aerospace-defense industry and wants production located in the US, Gelsinger said.

So far, the chipmaker has only been able to name one company that’s signed up to use 18A: Microsoft Corp. It plans to rely on Intel to produce certain types of in-house chip designs that the software maker is working on.

--With assistance from Ed Ludlow and Caroline Hyde.

(Updates with closing shares in the first and sixth paragraphs.)

©2024 Bloomberg L.P.